Nigeria Residential Real Estate Forecast 2026

Nigeria’s residential real estate sector enters 2026 at a pivotal moment, supported by strong demographic momentum, accelerating urban migration, and a gradually stabilising economy. The country’s population is projected to approach 260 million by 2026, continuing to swell urban centres and intensify housing demand. Real estate already contributes a significant share of national economic output, underscoring its importance as both a growth driver and a store of value.

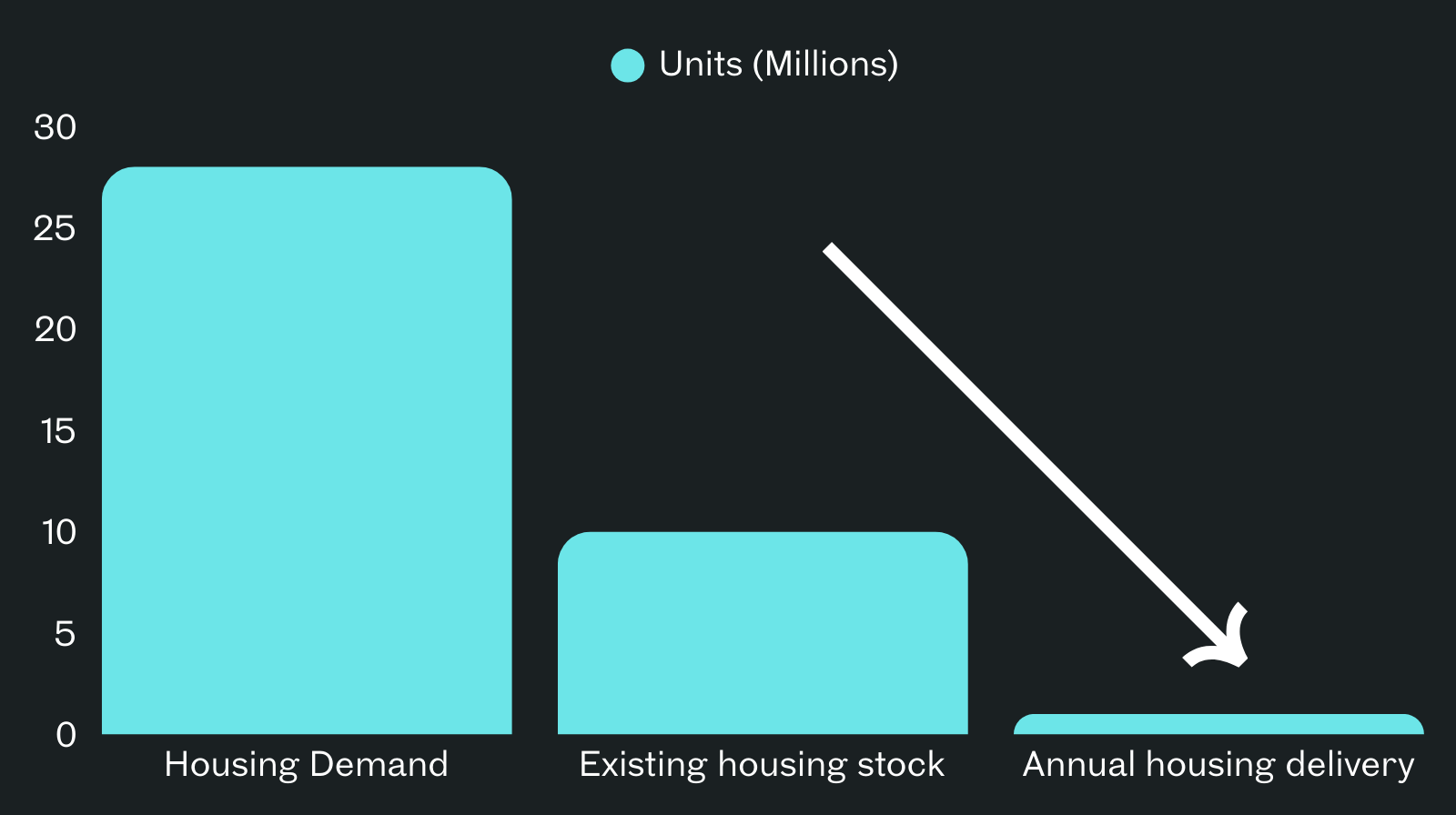

Despite this importance, the market continues to face deep structural challenges. These include a housing deficit estimated between 22 and 28 million units, limited access to mortgage financing, and persistently high construction costs driven by inflation and currency pressures. This report presents a comprehensive forecast of Nigeria’s residential real estate market in 2026, combining a nationwide outlook with dedicated analysis of Lagos and Abuja, the country’s two most influential property markets.

Key areas examined include demand and supply dynamics, pricing and rental projections, investment opportunities, regulatory developments, and infrastructure expansion. The objective is to provide investors, developers, and analysts with a clear and practical outlook for the year ahead.

Nationwide Market Trends and Outlook (2023–2025)

Rapid urbanisation and population growth remain the primary drivers of housing demand heading into 2026. Major cities continue to attract migrants seeking economic opportunity, deepening the housing shortfall. Although new residential estates are delivered each year, demand continues to significantly outpace supply, sustaining upward pressure on both home prices and rents.

The national housing deficit has shown little meaningful reduction, highlighting the urgency of large scale affordable housing development. Urban centres such as Lagos, Abuja, Port Harcourt, and Ibadan have experienced steady increases in land and home prices, with particularly strong activity in suburban fringe areas where land availability is higher. In Ibadan, for example, demand in peripheral neighbourhoods has continued to rise despite uneven infrastructure provision.

This peri-urban expansion reflects a broader shift as buyers and developers search for lower-cost alternatives to increasingly unaffordable city centres. At the same time, housing preferences are evolving. Many buyers, particularly upwardly mobile millennials and members of the diaspora, are seeking more than basic shelter. Demand is rising for modern, lifestyle-oriented housing that incorporates energy efficiency, technology integration, flexible layouts, and in some cases short-let or work-from-home features. These preferences are expected to shape new housing supply through 2026.

Home Prices: Inflation and Localised Growth

Residential property prices nationwide have risen consistently since 2020, with momentum extending through 2024 and 2025. High inflation and currency weakness in 2023 pushed construction costs upward, feeding directly into higher home prices. However, the pattern of price growth has become increasingly localised rather than uniform across markets.

Prime neighbourhoods in major cities are maturing and have begun to record more moderate appreciation, while emerging districts with new infrastructure and development pipelines have experienced sharper price increases. In Lagos, some segments recorded exceptional growth in 2024, a pace unlikely to be repeated annually. By 2025, the market began to transition toward more sustainable growth levels.

For 2026, residential price growth in key cities is expected to fall within a range of approximately 5 to 15 percent. Fully developed high-end districts are likely to sit at the lower end of this range, while emerging hotspots linked to infrastructure and economic activity could achieve higher appreciation. This reflects a shift away from speculative cycles toward growth driven by genuine end-user demand.

Encouragingly, Nigeria’s real estate market has shown resilience amid recent economic volatility. By late 2025, inflation had begun to ease, currency conditions had stabilised, and investor confidence showed signs of recovery, reflected in rising transaction activity. If macroeconomic reforms continue to hold, 2026 may offer a more stable environment for real estate performance. That said, construction costs remain elevated, particularly for labour and imported materials, keeping prices for new developments under sustained pressure.

Rental Market and Rate Projections

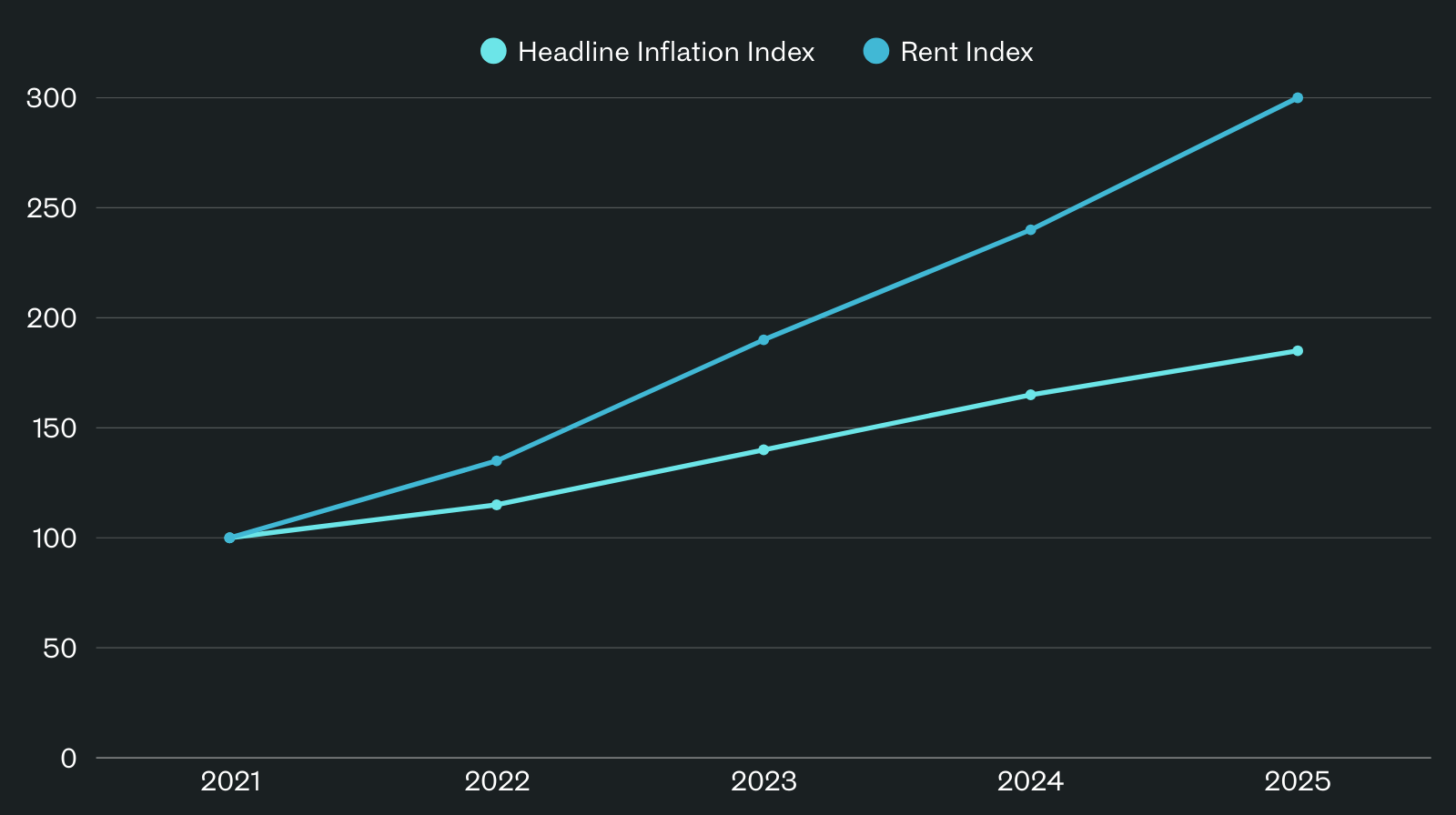

The rental market has faced extraordinary pressure over the past several years, with rent increases far exceeding general inflation. While headline inflation remained high, rents in major cities rose at multiples of that rate, driven by severe housing scarcity and rising landlord cost expectations. This dynamic has contributed to what many market participants describe as a rental affordability crisis.

In several urban markets, rents effectively doubled within a short period, resetting affordability benchmarks. While such extreme increases are unlikely to persist indefinitely, they have established a higher base level. For 2026, rental rates are expected to remain elevated and continue rising, though potentially at a slower pace if additional supply enters the market.

Residential rental yields are expected to stabilise around mid-single-digit levels in major cities, assuming both rents and capital values continue to rise. However, if aggressive rent increases persist unchecked, tenants in cities such as Lagos and Abuja could face another difficult year. Policy responses, including incentives for rental housing development or renewed debate around rent regulation, will be important to monitor.

Investment Hotspots and Opportunities

As the broader market expands, investor attention is increasingly focused on specific locations with above-average return potential. These hotspots are often found at the edges of major cities or in strategic growth corridors where infrastructure projects or new economic activity are unlocking land value.

Transport Infrastructure Corridors

Major road, bridge, and rail investments continue to elevate property values along their paths. Highway upgrades and urban rail projects have reduced travel times and expanded the practical boundaries of city living, driving residential demand in newly connected areas. Investors who position early in these corridors often benefit as connectivity improves and neighbourhood perception shifts.

New Economic Zones and Peri-Urban Expansion

Industrial zones, ports, refineries, and technology clusters act as magnets for residential growth. Areas surrounding such developments have transitioned rapidly from peripheral locations to high-growth residential markets. Continued investment in these zones is expected to reinforce their importance through 2026.

Mid-Market and Affordable Housing

One of the most compelling opportunities lies in the mid-market and affordable housing segments. In several cities, high-end residential supply has outpaced effective demand, leading to vacant luxury units. By contrast, demand for affordable and mid-tier housing remains deep and largely unmet. Developers focused on these segments are likely to benefit from strong absorption and more resilient demand.

Rental housing, short-let apartments, co-living spaces, and student housing are also expected to remain resilient as household formation continues to outstrip ownership affordability.

Regulatory and Policy Developments

Housing policy has increasingly moved into focus, with government interventions aimed at improving financing access and housing delivery. Public sector funding initiatives and tax incentives have sought to stimulate development and reduce barriers for developers and mortgage providers.

However, regulatory bottlenecks persist. Land titling and planning approvals remain time-consuming and costly in many states, adding friction to housing delivery. Industry stakeholders continue to advocate for streamlined processes, digital land registries, and standardised approval timelines.

Monetary policy remains a key variable. High interest rates have largely excluded mortgages from the mainstream market, forcing real estate transactions to remain predominantly cash-based. If inflation continues to ease, interest rate reductions could provide limited relief by 2026, though widespread affordable mortgage access remains unlikely without structural financial reforms.

Land reform is another area to watch. While discussions around improving land acquisition and transfer processes continue, significant legislative change has yet to materialise. Incremental improvements, particularly in urban land administration, could have meaningful long-term impacts.

Infrastructure and Urban Development

Infrastructure development remains the most powerful driver of residential real estate performance. Large-scale investment in transport, utilities, and urban resilience continues to reshape cities such as Lagos and Abuja.

Urban rail systems, highway expansions, and new bridges are expanding viable residential zones and encouraging transit-oriented development. Road improvements are unlocking suburban land and enabling more affordable housing options for commuters. New city developments, industrial hubs, and technology clusters are further reinforcing demand in surrounding residential areas.

Climate resilience and sustainability have also become increasingly important, particularly in coastal cities. Flood mitigation, drainage upgrades, and environmentally conscious building practices are influencing both investor confidence and buyer preferences. Sustainable design features are becoming more prominent, particularly in higher-end developments, and may increasingly affect marketability and long-term value.

Lagos Real Estate Outlook 2026

Lagos remains Nigeria’s most dynamic and constrained residential market. Extreme density, limited land availability, and concentrated economic activity continue to push prices higher than in any other city. Demand remains strong across most segments, though affordability pressures are increasingly visible.

Prime neighbourhoods such as Ikoyi, Victoria Island, and Lekki Phase One are expected to see moderate growth as mature markets with high price bases. Stronger momentum is likely to persist in emerging districts and middle-income areas, particularly along infrastructure corridors and growth axes.

The Lekki to Epe corridor remains a focal point, driven by ports, industrial development, and planned transport infrastructure. Mainland areas benefiting from rail connectivity and road upgrades are also attracting renewed investor interest. At the same time, the market faces a paradox of overall undersupply alongside pockets of luxury oversupply, prompting a gradual shift toward smaller units, cost-efficient construction, and mid-market housing.

Rental conditions remain tight, with rents expected to rise further in 2026, though at a slower pace than in the immediate past. Short-let rentals continue to grow, particularly in high-demand areas, offering higher yields but contributing little to easing mainstream rental pressure.

Abuja Real Estate Outlook 2026

Abuja presents a more structured and less volatile residential market. As a planned city and the nation’s political centre, housing demand is anchored by government institutions, diplomatic missions, and a growing professional population.

Prime districts such as Maitama, Asokoro, and Wuse II are expected to retain their premium status, with limited supply supporting stable pricing. Growth opportunities are more pronounced in expansion districts and suburban areas where land remains available and infrastructure is improving.

Mid-market areas such as Gwarinpa, Jahi, and Katampe Extension continue to attract demand, while more affordable zones including Lokogoma, Kabusa, and Kuje are emerging as important growth frontiers. These areas benefit from population spillover and improving connectivity, though infrastructure delivery remains a key risk.

Abuja’s rental market has experienced significant increases, though generally less extreme than Lagos. Demand remains strong, supported by government employment cycles and population inflows. Rental yields are expected to remain stable, with occupancy levels high across most segments.

Conclusion and Key Takeaways

Nigeria’s residential real estate outlook for 2026 is characterised by cautious optimism. Strong demographic fundamentals, ongoing urbanisation, and infrastructure investment continue to support demand. At the same time, affordability constraints and supply limitations remain significant challenges.

Lagos and Abuja exemplify the broader national trend of strong potential tempered by structural gaps. Price growth is expected to continue, though increasingly concentrated in locations aligned with infrastructure, employment, and affordability realities.

Key themes to watch in 2026 include macroeconomic stability, election cycle dynamics, policy efforts to expand affordable housing, the growing role of sustainability and technology, and the continued influence of infrastructure investment on residential value creation.

Overall, Nigeria’s residential real estate market is expected to grow in scale and sophistication in 2026. Investors and developers who approach the market strategically, with a clear understanding of regional dynamics and long-term drivers, will be best positioned to navigate the opportunities and risks ahead.