Rising Government Allocations Fail to Ease Poverty and Housing Pressure

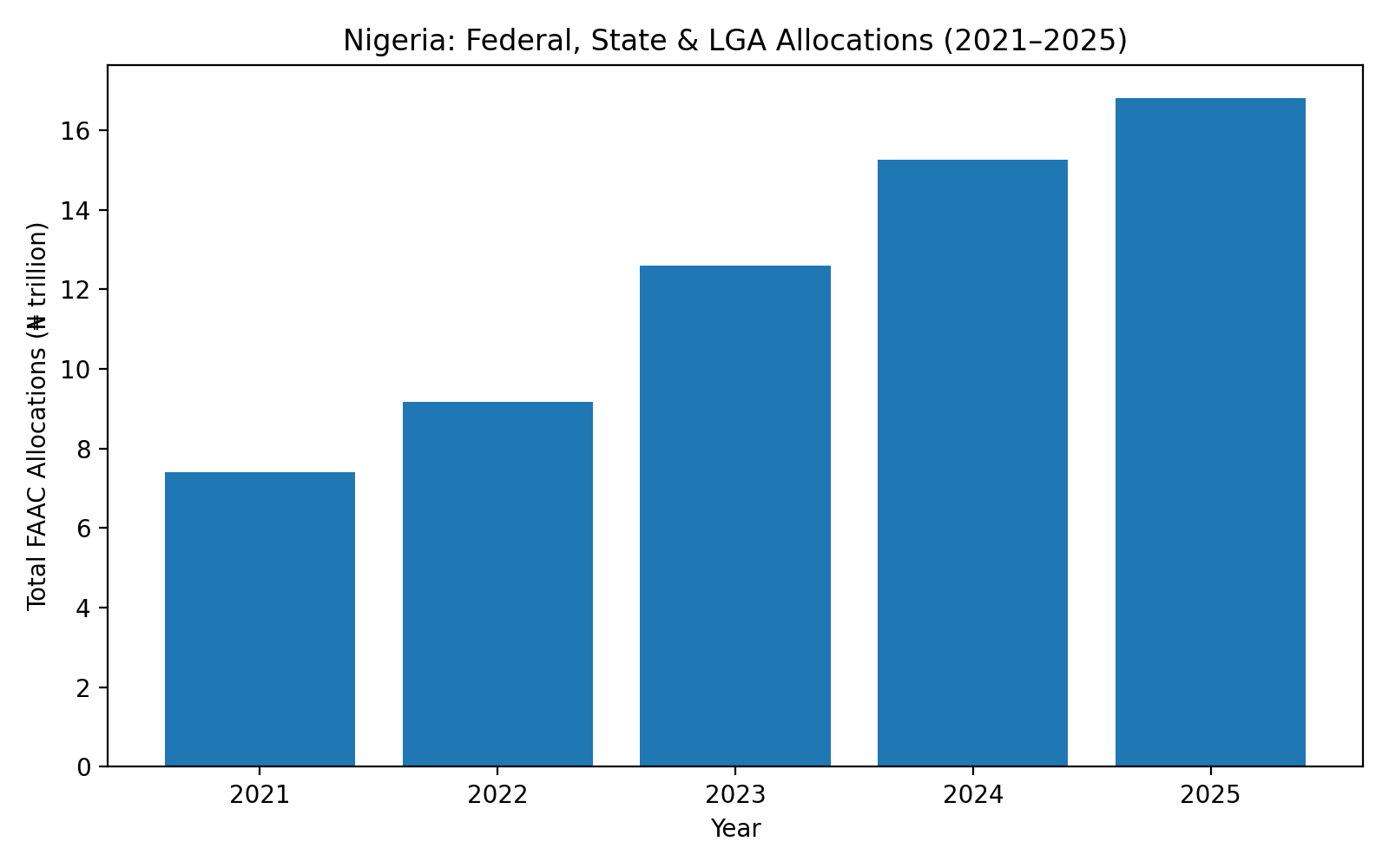

Nigeria’s public revenues have expanded sharply over the past four years, yet living conditions for millions of citizens continue to deteriorate. Data from the Federation Accounts Allocation Committee (FAAC) show that allocations shared among the Federal Government, state governments, and Local Government Areas have more than doubled since 2021, even as poverty levels continue to rise across the country.

Between 2021 and 2025, total allocations grew from an estimated ₦7.4 trillion to nearly ₦17 trillion. The increase has been driven by higher oil revenues, exchange rate adjustments, and broader fiscal inflows to government at all levels. States and local governments, in particular, have recorded strong year on year growth in statutory allocations.

Despite this expansion in public funds, economic hardship remains widespread.

Rising Allocations, Falling Living Standards

For households, the surge in government revenue has not translated into improved purchasing power. Inflation remains elevated, while food prices, transport costs, rent, and utilities continue to rise faster than incomes. As a result, the real value of government spending has been significantly eroded.

Poverty indicators highlight the growing disconnect. Nigeria’s poor population has expanded sharply in recent years, with a majority of households struggling to meet basic needs. Higher allocations, when adjusted for inflation, have failed to provide meaningful relief for low income earners.

Analysts note that fiscal growth in nominal terms masks deeper structural challenges including weak productivity, limited job creation, and inefficiencies in public spending.

Accountability and Development Gaps

Concerns are also growing over how increased allocations are being deployed at the subnational level. While state and local governments now receive substantially more funds than four years ago, outcomes in housing delivery, infrastructure, healthcare, and education remain uneven.

Urban centres continue to face housing shortages, rising rents, and overstretched infrastructure. In many cities, demand for affordable housing far outpaces supply, pushing more households into informal or overcrowded living arrangements.

Implications for Housing and Real Estate

For Nigeria’s housing market, the trend carries serious implications. Rising poverty and declining real incomes are reshaping demand, with stronger pressure on low cost rentals and weaker affordability for home ownership. Developers face higher construction costs, while buyers struggle with limited access to mortgage finance.

Without targeted investment in housing, infrastructure, and employment generating sectors, experts warn that increased public revenue alone will not reverse the affordability crisis.

Looking Ahead

Nigeria’s fiscal numbers suggest a government sector with more money at its disposal than in previous years. The challenge remains converting those funds into tangible improvements in living standards. As allocations continue to rise, the focus is shifting from how much is shared to how effectively it is spent.

For millions of Nigerians, the reality remains unchanged. More money is flowing through government accounts, but daily life is becoming more expensive, more uncertain, and increasingly out of reach.