LandSafe is Digitising Property Verification in Nigeria—and It Could Save Buyers Billions

LandSafe is the answer to the property verification pandemic in Nigeria. The legaltech startup will solve the billion-naira problem of real estate scams in the country.

When Adetunde Ogunlesi returned to Nigeria to inspect the half-acre plot he’d purchased in Lekki, he expected to see the future site of his retirement home. Instead, he met three other individuals, each claiming ownership of the same land, and each holding what appeared to be valid documentation.

“I followed the proper channels, used a family-recommended agent, hired a lawyer, everything!” Ogunlesi explained, still shaken by the ordeal. “Now they’re telling me my Certificate of Occupancy isn’t even on record.”

His experience is unfortunately not unusual. Property scams in Nigeria have become a lucrative criminal enterprise, costing the economy roughly $4 billion a year. The Economic and Financial Crimes Commission (EFCC) ranks land fraud among the country's top financial crimes, and Lagos alone has logged more than 1,500 related cases since 2020.

Amidst this, the Nigerian Institution of Estate Surveyors and Valuers provides even more disappointing information that only 3% of Nigerians have a valid land title and fewer than 10% of lands in Nigeria are formally documented according to Arc. Ahmed Musa Dangiwa, the Minister of Housing and Urban Development,.

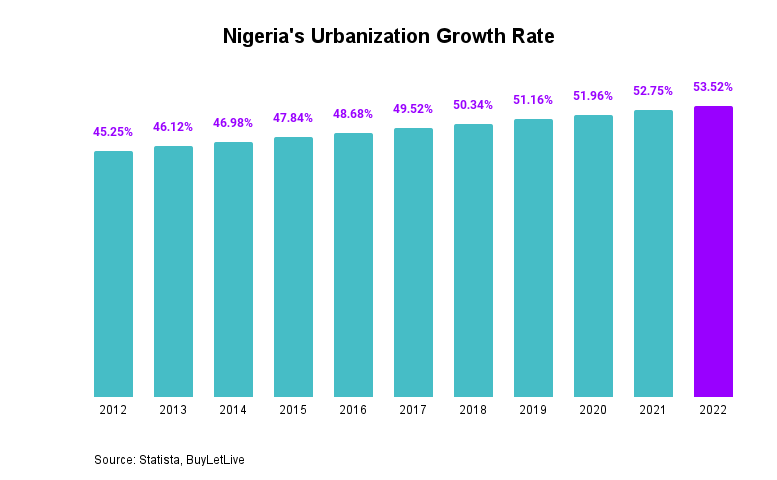

With Nigeria's housing deficit hovering around 17 million homes and urban growth accelerating, land is in high demand—making it an easy target for fraud. According to the Nigerian Institution of Estate Surveyors and Valuers (NIESV), the root of the problem lies in glaring gaps in verification and documentation systems.

The Trouble With Land Records

Much of Nigeria’s land ownership structure stems from the 1978 Land Use Act, which vests land control in state governors. While the Act aimed to streamline land administration, it also created a centralised and often inefficient system with outdated record-keeping and minimal digitisation. That lack of transparency is precisely what scammers exploit.

“We’re working with a regulatory system that predates modern technology,” says Temiloluwa Dosumu, CEO and founder of LandSafe, a digital property verification platform. “What was meant to protect the public has become easy to exploit.”

Temi Dosunmu, LandSafe’s Founding CEO

Dosumu, a legal and tech expert, previously worked with top law firms and government agencies on land recovery and due diligence. His deep understanding of Nigeria’s real estate laws positioned him to lead a new generation of solutions through technology.

A Smarter, Faster Way to Verify Property

Enter LandSafe—a proptech platform, designed to prevent the kind of nightmare Ogunlesi, as well as thousands of Nigerians, face, according to TechCabal. The company allows users to verify property within 24 to 48 hours, a process that used to take up to a week through traditional channels.

LandSafe uses technology to verify land and property in Nigeria || Lagos, Nigeria

“What we’re building is a digital trust layer for the Nigerian real estate and property market,” says Dosumu. “Property buyers—whether locals or diaspora—shouldn’t need to jump through hoops just to confirm ownership.”

Unlike relying on individual lawyers or agents, LandSafe runs on a tech-first model. The platform uses artificial intelligence, a network of vetted legal professionals, and access to public registries to authenticate property documents, check for encumbrances, and flag ownership disputes—quickly and securely.

LandSafe is also designed to integrate with banks, fintechs, and real estate firms, offering streamlined property verification as part of broader financial services.

A Massive Market Opportunity

Currently active in Lagos, Abuja, and Ogun State, LandSafe is already tackling a market where over 500,000 property-related fraud cases are reported each year. And with $3.7 billion in annual real estate transactions nationwide, the potential for expansion is huge.

Industry observers are taking note. Adegbemi Odungbawa, former president of a Nigerian mortgage banking association, sees platforms like LandSafe as a necessary step forward. “The potential impact is twofold—preventing fraud and enabling quicker access to credit, especially for microfinance institutions that rely on land as collateral.”

How To Verify Real Estate In Nigeria?

Verifying real estate in Nigeria is as simple as logging into LandSafe and getting a comprehensive report in hours.

The process naturally demands rigorous due diligence that many property buyers often overlook. LandSafe has streamlined this critical process for both individual and institutional investors, offering comprehensive verification services across Abuja, Lagos and Ogun states.

The verification process begins with title document authentication, where experts cross-reference property documents with official land registries to confirm legitimacy. This crucial step identifies forged Certificates of Occupancy, Survey Plans, and other fraudulent ownership claims immediately.

Next, physical land inspection confirms boundary accuracy and identifies potential encroachment issues, while legal searches reveal existing liens, encumbrances, or litigation affecting the property.

LandSafe's technology platform integrates these verification steps, delivering detailed property reports within 24-48 hours, compared to the industry standard of 5-7 days.

For diaspora investors particularly vulnerable to "Omo Onile" scams, LandSafe's digital verification platform provides remote access to comprehensive property checks before transferring funds.

“The simplest path to verifying real estate in Nigeria is to visit LandSafe and click: “Verify Now”—or “Speak to an expert”, if you’d like to have a chat with a team member before proceeding with your verification or land purchase.

This land verification process is essential before purchasing any property in Nigeria, as it eliminates the significant financial risk posed by the country's widespread land fraud issues.

Why It Matters Now More Than Ever

With the federal government promising to deliver 300,000 homes through its Renewed Hope Housing Scheme, trust in Nigeria’s property system has become essential. And it’s not just a local issue. Global investors are increasingly eyeing Nigeria’s real estate sector—but many remain wary due to transparency issues.

“There's a clear link between verification and investor confidence,” says Dosumu. “We want to de-risk real estate so capital can flow in—both from local banks and international investors.”

Foreign investment in the sector is expected to rise by 15% in 2025, and analysts agree that platforms like LandSafe could be the key to unlocking this growth.

For buyers like Ogunlesi, the damage is already done. After a lengthy legal battle, he recovered just 40% of his investment. But he remains hopeful that others can avoid his fate.

“No one should have to choose between the dream of owning a home and the risk of losing everything,” says Caleb Nnamani, who drives storytelling for LandSafe. “We’re building a system where trust is standard—not a privilege.”