New Tax Law: Why Nigerian Traders are Returning to Cash Over Bank Transfers

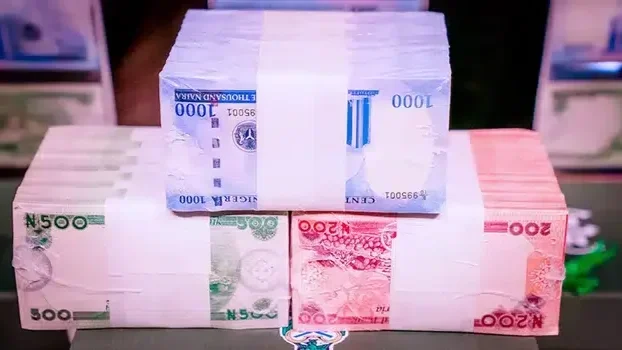

Bundles of naira banknotes

A recent study by the News Agency of Nigeria (NAN) reveals a significant shift in consumer and merchant behaviour as small-scale traders and business owners increasingly prioritise cash payments over bank transfers. This trend emerged following the official commencement of the 2026 tax regime on 1 January 2026, which introduced several structural changes to transaction levies and digital oversight.

Shift in Digital Payment Costs

A primary driver for the resurgence of cash is the reclassification of the Electronic Money Transfer Levy (EMTL) as a formal stamp duty. Under the Nigeria Tax Act 2025, the ₦50 charge on electronic transfers of ₦10,000 and above has transitioned from a recipient-based deduction to a sender-based fee. For consumers, this turns what was previously an "invisible" cost into a visible, immediate transaction expense.

Traders interviewed in the NAN study indicated that the cumulative effect of these charges, combined with existing bank transfer fees, has made digital payments less attractive for low margin transactions. By opting for cash, both merchants and customers circumvent the ₦50 stamp duty and the ₦10 to ₦50 tiered bank charges, effectively reducing the cost of commerce at the retail level.

Tax Oversight and Informality

Beyond the immediate costs, the study highlights a growing apprehension regarding the increased visibility of digital footprints. The new laws mandate the use of Tax Identification Numbers (TIN) for all business accounts and require financial institutions to standardise data sharing with the National Revenue Service (NRS).

Experts suggest that the pivot to cash is a defensive mechanism by the informal sector to avoid potential tax assessments. While the Nigeria Tax Act 2025 provides significant exemptions including a zero percent Corporate Income Tax rate for small companies with a turnover below ₦100 million many micro-entrepreneurs remain wary of the administrative burden and the "fiscalisation" of their accounts.

Regulatory Clarification and Expert Perspectives

In response to the shifting market sentiment, government officials have attempted to clarify misconceptions. Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, recently emphasized that the reforms are intended to simplify compliance rather than penalise small earners. He noted that the ₦800,000 annual tax-free threshold for individuals is designed specifically to protect low-income earners.

However, the NAN study suggests a gap between policy intent and public perception. Many traders view the requirement for transaction narrations and digital tracking as an intrusive measure, despite official assurances that the government will not arbitrarily debit personal bank accounts for tax purposes.

Long-term Outlook for the Digital Economy

The return to cash poses a challenge to Nigeria’s "Cashless Policy" and the growth of the fintech sector. As digital payments become more expensive for the sender, analysts predict a potential slowdown in the volume of electronic transactions in the first quarter of 2026. For policymakers, the challenge lies in balancing the need for non-oil revenue generation with the goal of financial inclusion.

For investors and professionals, this shift underscores the importance of monitoring consumer behaviour in response to fiscal policy. While the formal sector may experience streamlined administration through unified Tax IDs, the informal sector's move toward cash could lead to a fragmented economic landscape in the near term.