Naira Records Opening Gains at Official Market as February Trading Commences

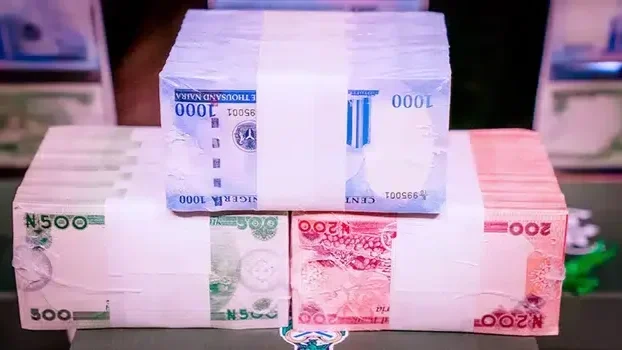

Nigeria Naira Notes

The Nigerian Naira began the month of February 2026 on a positive trajectory, strengthening against the United States Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM). As trading opened for the week on Monday, 2 February 2026, the local currency maintained its momentum from January, supported by improved liquidity and a significant rise in the nation's external reserves.

Data from the FMDQ Securities Exchange indicates that the Naira showed resilience in the official window, following a strong close in January where it settled at ₦1,386.55/$1. Market analysts attribute this stability to a combination of enhanced price discovery mechanisms and a surge in offshore investor confidence.

External Reserves Hit Eight-Year High

A primary driver of the Naira’s recent performance is the robust growth of Nigeria's gross external reserves, which climbed to $46.18 billion as of late January 2026. This represents an 18.6% increase compared to January 2025 and marks the highest level recorded in eight years.

According to reports from the Central Bank of Nigeria (CBN), the reserve build up is fueled by:

Increased Crude Oil Receipts: Higher export volumes and stable global oil prices.

Diaspora Remittances: Consistent inflows from Nigerians abroad.

Foreign Portfolio Investments (FPIs): Renewed interest from international investors following FX market reforms.

The current reserve level is estimated troximately 14 months of import cover, granting the apex bank significant capacity to defend the local currency against speculative attacks.

Market Performance and Projections

While the Naira saw minor fluctuations during the first trading session of the month at one point trading in the ₦1,390/$1 range the overall sentiment remains bullish. In the parallel market, the currency traded consistently between ₦1,440 and ₦1,465/$1, narrowing the gap between official and informal rates.

“The Naira is expected to remain volatile but broadly stable, with modest appreciation in February,” noted analysts at Cowry Asset Management Limited.

The $1 trillion economy target by 2030 remains a focal point for the Tinubu administration, with the CBN projecting that external reserves could rise further to $51.04 billion by the end of 2026 if current fiscal and monetary reforms are sustained.